Following Monday’s crypto market crash, nearly $2.5 billion worth of Bitcoin (BTC) and Ethereum (ETH) options are set to expire today.

Expiration dates can impact market conditions, and investors are monitoring potential changes.

$2.5 Billion in Options Contracts Expiring: Will Crypto Markets Sustain Their Recovery?

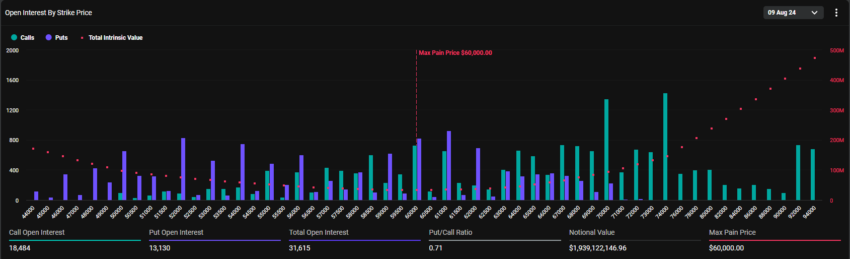

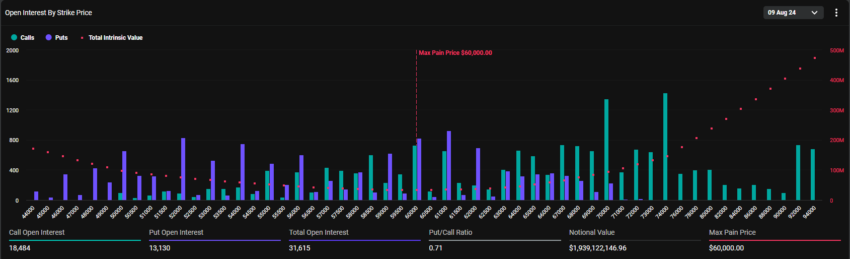

$1.94 billion worth of Bitcoin options are set to expire, according to Deribit. The maximum pain point for these contracts is $60,000.

Bitcoin options expire. Source: Deribit

These options comprise 31,615 contracts, down slightly from 36,732 contracts last week. The put/call ratio of 0.71 indicates overall bullish sentiment despite recent volatility.

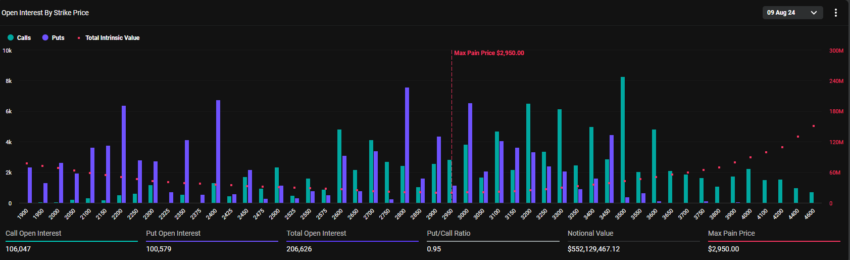

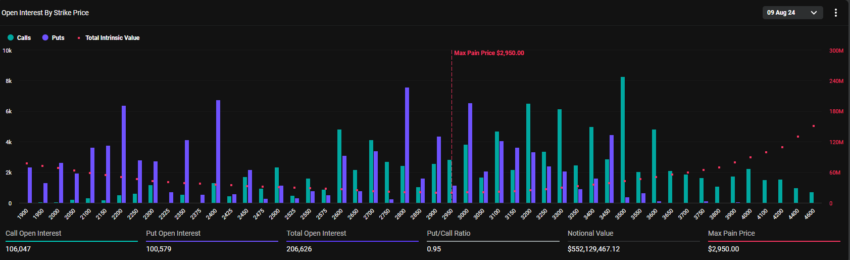

Ethereum has $552.13 million worth of options expiring, including 206,626 contracts. The figure is up from 183,756 contracts in the previous week. The maximum pain point for these options is $2950 and the put/call ratio is 0.95.

Ethereum options expire. Source: Deribit

The maximum pain point in the crypto options market is the price level that causes the greatest financial discomfort to option holders. Meanwhile, the put/call ratio indicates a higher prevalence of call options over put options.

Analysts from crypto options trading tool Greeks.live provided information about today’s contract expiration. They noted that implied volatility (IV) of all key terms remains high, exceeding 60%. Meanwhile, Bitcoin’s current 7-day realized volatility (RV) is at 100%, far exceeding IV.

“Volatility has an aggregation effect, leading to a longer period after strong fluctuations, so IV has strong support and sellers can gradually increase positions,” the Greeks commented.live analytics.

BeInCrypto reported that the prices of Bitcoin and Ethereum fell significantly during the market crash on Monday. The severity is evident in liquidations, which have exceeded $1 billion, according to Coinglass data.

However, the very next day after the crash, the cryptocurrency market began to recover. At the time of writing, Bitcoin has risen above $60,000 again. It is now trading at $61,494, up nearly 10% in just 24 hours.

Similarly, Ethereum has risen nearly 12%, now trading at $2,671 after briefly reaching $2,700.

Historically, the expiration of options contracts has tended to cause sharp but temporary price movements. The market usually stabilizes shortly thereafter. Ultimately, traders must remain vigilant by analyzing technical indicators and market sentiment to effectively manage potential volatility.