Распродажа криптовалют на $510 млрд сводит на нет прибыль 50 лучших монет в 2024 году

-

Altcoin News

Bitcoin news

Blockchain News

blog

DeFi News

Exchange News

General

Market News

Prediction

Без рубрики

2024/08/10

2 mins read

More than half of the top 50 cryptocurrencies by market cap are in the red after the biggest crypto sell-off in a year.

The entire cryptocurrency market saw its total market capitalization fall by $510 billion.

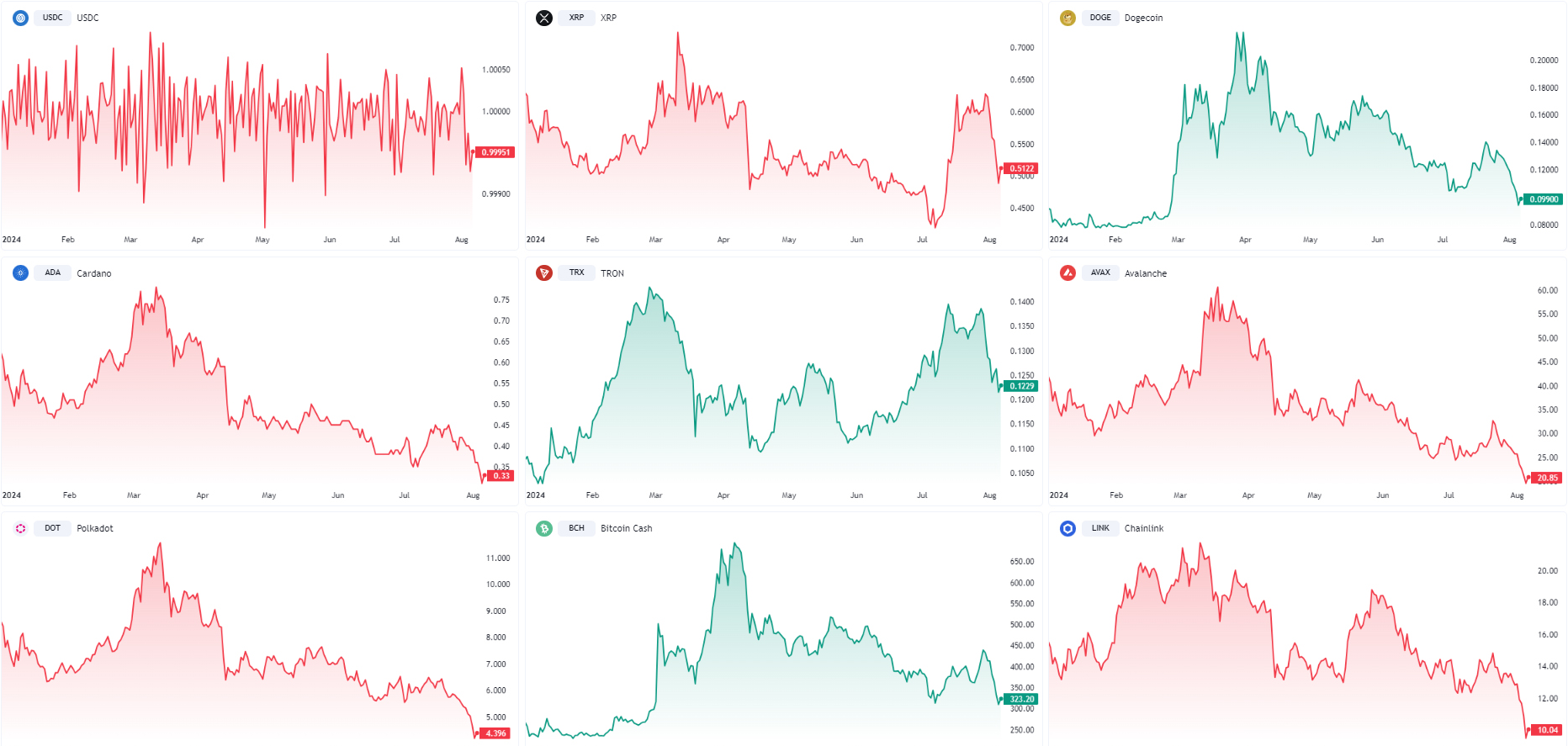

Following the sell-off, more than 60% of the top 50 cryptocurrencies have lost all of their gains in 2024, according to CryptoQuant author Binhdangg, who wrote in an August 6 post:

“After Black Monday, 60% of the top 50 coins have erased all their gains since the start of 2024 and even suffered losses.”

Top 50 Cryptocurrencies, Performance. Source: Binhdangg.

Following the sell-off, Ethereum briefly dipped to a five-month low below $2,200. Losing that psychological mark could trigger an even bigger panic sell-off and downward pressure on the entire market.

What Caused the Cryptocurrency Market Selloff?

The brutal sell-off in the cryptocurrency market was caused by a combination of macroeconomic and industry events.

On August 5, the Bank of Japan announced an increase in the interest rate from 0% to 0.25%.

Japan’s decision had a direct impact on the US stock market and the price of Bitcoin, as traders borrowed Japanese yen at low interest rates to buy assets in the US market.

Meanwhile, the top five market makers have sold a total of 130,000 ETH worth $290 million at current prices since August 3, when Ether’s price fell from $3,000 to below $2,200.

Among market makers, Wintermute sold over 47,000 ETH, followed by Jump Trading with over 36,000 ETH and Flow Traders with 3,620 ETH in third place.

The selling of ether by market makers contributed significantly to the decline in the price of ETH.

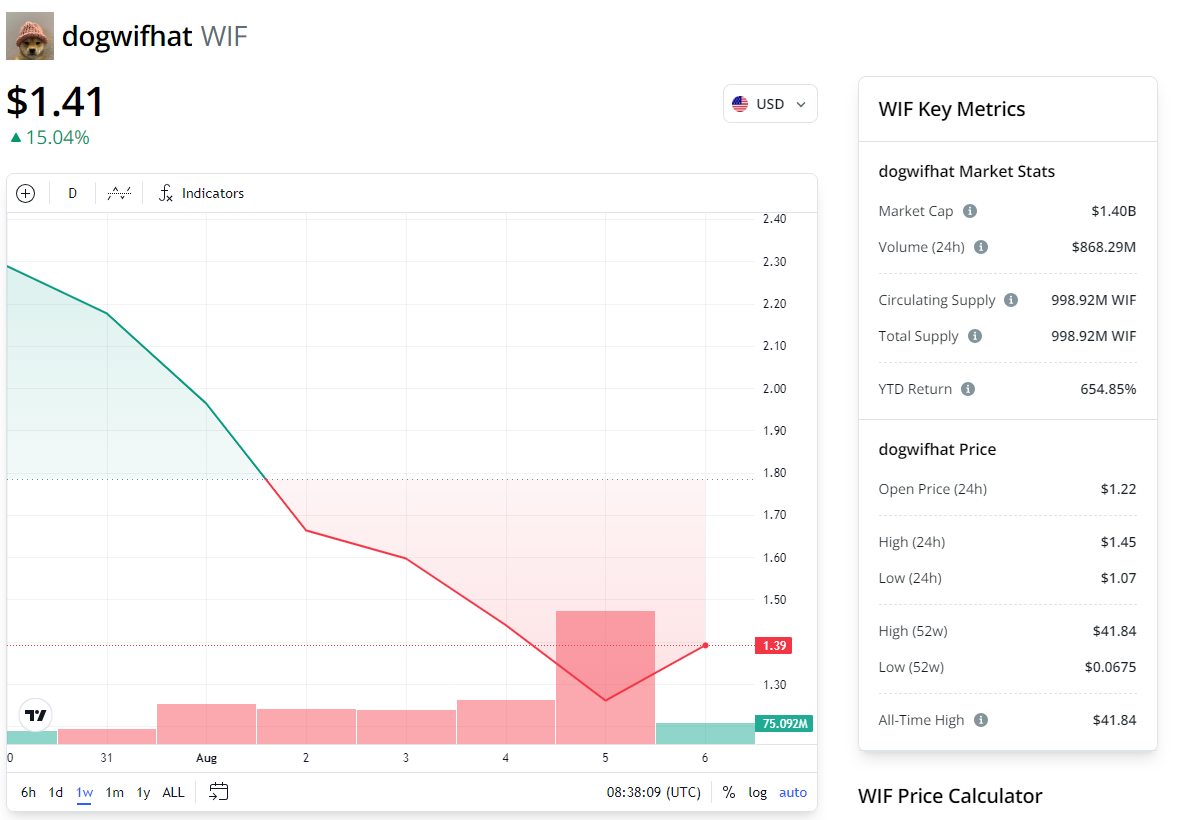

Memcoins suffered the biggest losses, led by WIF and PEPE

Looking at the top 50 tokens by market cap, some of the most popular memecoins of this cycle have suffered the biggest losses.

On the weekly chart memcoin Dogwifhat (WIF) on the blockchain Solana (SOL) suffered the biggest losses, falling more than 41% over the past week to trade at $1.38 as of 8:37 UTC on August 6.

WIF/USD, weekly chart.

Meme coin Pepe (PEPE) The frog-themed stock posted its second-biggest weekly loss, falling more than 34% to $0.057781, down 53% from its all-time high set in late May.

Because meme coins have no intrinsic value, their growth is primarily driven by social media hype and retail investor attention. As a result, meme tokens often suffer the most during crypto market corrections.