What happened to the metaverse? Teaching from the Dotcom bubble

-

Altcoin News

Bitcoin news

Blockchain News

blog

DeFi News

Exchange News

General

Market News

Prediction

Без рубрики

2025/07/14

6 mins read

It has almost been a year ago that Facebook CEO and Pantomime Böse weight, Mark Zuckerberg, has announced that his company will be renamed Meta.

It was an important statement about the direction of the metaverse, of which many began to explain that it would include everything, from social contacts to transactions, work and entertainment.

And like me last week wrote, this bet was not well out for the billionaire.

But do we see the same pattern on the entire market? Is there any interest in the metaverse?

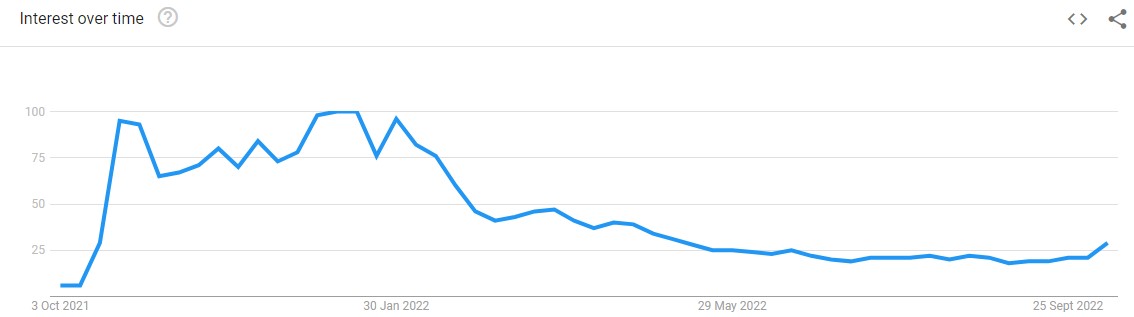

My first point of contact was Google, where the search analyzes show a strong increase in interest in the term “meta -verse” after Zuck put everything on one card in October last year. It wasn’t long after it went steadily downhill.

Undoubtedly an alarming diagram. But how much of this can be attributed to the concept of the meta -severse itself, and how much is only a consequence of the general macroeconomic environment?

It is difficult to say, but there is no question that many Metaverse projects have been significantly overrated. It is possible to believe in the metaverse, but at the same time think that many of the tokens in the room are either overrated, offer minimal benefits or both.

One thing that I still don’t understand is why so many investors are willing to put money in everything that has to do even remotely with the metaverse, regardless of whether the investment has a demonstrable plan to gain a market share in the ultimate meta -severse, whatever it may look like.

Surely these blind bets have fallen from a cliff now that the market is so brutal, but many of these companies still have very high ratings, even after declines of over 80 %.

Die Dotcom-Blase

Let us not forget that the Internet has changed the world immeasurably and even exceeded the expectations of the greatest bulls. And yet remember how many companies have lost while the dotcom bubble spent.

Priceline.com is a moving reference. You may not recognize this name today, but the company was once one of the largest internet companies. The thesis was tempting: of half a million flight tickets that remain unsuccessful every day, customers were able to enter the price they were willing to pay at Priceline.

In this way, the airlines got rid of their excess stocks, the customers used cheap places, and the market was in balance. It’s kind of logical, isn’t it? And all the time, Priceline took a share of every transaction.

An apparently reasonable business plan, a gap in the market and something to which people at parties with “Oooh, that’s so clever”.

It started in 1998 and had sold 100,000 tickets within seven months. Just 13 months after the start, it went to the stock exchange for $ 16 per share. The course rose to $ 88 on the first day and finished $ 69. There were plans to extend the system to other areas – why shouldn’t it also work for hotel rooms, train tickets and even mortgages?

The final course of $ 69 after the day of the IPO gave Priceline an evaluation of almost $ 10 billion. It was the most valuable company in the short history of the Internet.

And then it fell by 94%.

Of course, this story is not an isolated case. The NASDAQ lost more than a third 2000 a few more than a month after its maximum.

What does the Dotcom bubble have to do with the metaverse?

What brings me to my point. You could believe in the Internet without believing in all the companies that claim to be “internet companies”. These companies were notorious loss lovers, and the concept of a profit was unknown in the Dotcom Days. Priceline, for example, recorded losses of $ 142.5 million in its first quarters.

And yet the Internet has obviously changed the world.

There are many pricelines today. Perhaps the “profit” of the Dotcom era is the “benefit” of the Metaverse era. Before you invest in one of these tokens, ask yourself what you actually do? Do you have a clear roadmap to use the metaverse to create something of tangible value? The most important thing is there a benefit here?

They seem like basic questions. And that is somehow the point. They are really fundamental – but they cannot answer that many coins. Let’s not forget how easy it is to create a cryptocurrency; A simple copying and inserting creates one. Combine this with the fact that so much money has been flooded into the room – both by investors and VCS – and it is no surprise that so many tokens have collapsed completely.

There are ten pricelines for every Amazon.

And the other thing that needs to be mentioned here is that there is (obviously) no guarantee that the meta verse will only become nearly as influential for society as the Internet was. Even if the Internet reaches all conceivable goals, there are still a number of pricelines. Imagine how many it would be if the internet failed?

Final thoughts

Just because you believe in meta -verses, you shouldn’t rely blindly on everything that bears the name “Metaverse”.

In the foreseeable future, of course, every single cryptocurrency – whether in meta -verse or in other areas – will continue to follow the stock market, as the macroeconomic environment currently looks like. Even the cryptocurrencies that offer a benefit and could be able to distinguish themselves elsewhere will not bring any returns to the investors as long as the wider market continues to lag behind.

But even if the market is recovering, Metaverse-token still have to prove that they actually do something-which many cannot. As always with investments, it is therefore important to carry out a DUE diligence test of the coin in question, hide the noise and to ask the basic questions mentioned above.

Do not let metavers be seduced with sweet words. A utopian dream will not pay the bills at the end of the day, and we have the Dotcom bubble as proof of this.